Are Maintenance Services Taxable In Connecticut . Like most states that levy sales and. are services subject to sales tax in connecticut? here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. are services taxable in connecticut? Landscaping and horticulture services, window cleaning. certain services rendered at the residence of a disabled person: The state of connecticut does not usually collect sales taxes from the. Many services are subject to sales and use tax in connecticut. Business services impacted by taxation: repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services.

from truex-prestia.blogspot.com

repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. Like most states that levy sales and. The state of connecticut does not usually collect sales taxes from the. Landscaping and horticulture services, window cleaning. Many services are subject to sales and use tax in connecticut. are services subject to sales tax in connecticut? certain services rendered at the residence of a disabled person: here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. Business services impacted by taxation: are services taxable in connecticut?

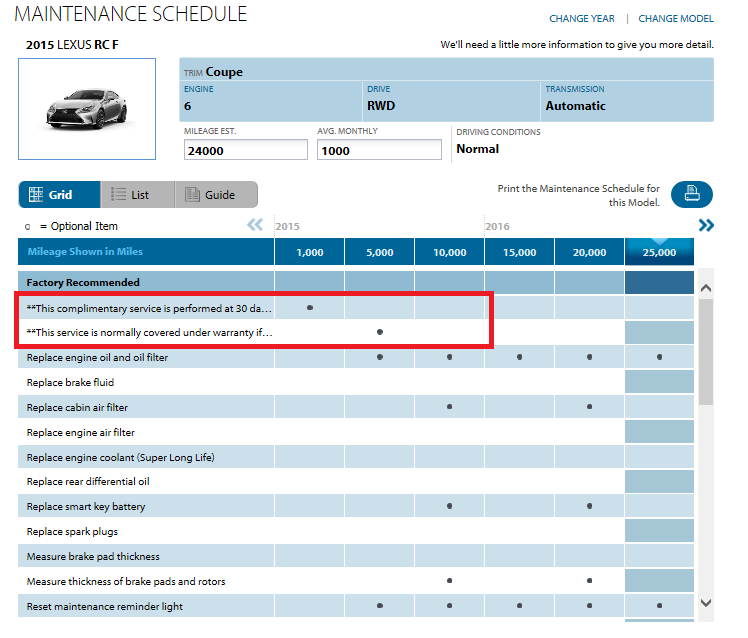

lexus ct200h maintenance schedule truexprestia

Are Maintenance Services Taxable In Connecticut are services taxable in connecticut? Landscaping and horticulture services, window cleaning. here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. The state of connecticut does not usually collect sales taxes from the. Many services are subject to sales and use tax in connecticut. connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. are services subject to sales tax in connecticut? certain services rendered at the residence of a disabled person: are services taxable in connecticut? Business services impacted by taxation: Like most states that levy sales and. repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;.

From taxconcept.net

Presumptive Taxation Scheme Section 44AD, 44ADA, 44AE [TAX ON Are Maintenance Services Taxable In Connecticut repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. certain services rendered at the residence of a disabled person: Many services are subject to sales and use tax in connecticut. are. Are Maintenance Services Taxable In Connecticut.

From www.youtube.com

Taxable And The Child Maintenance Service You Must Know This Are Maintenance Services Taxable In Connecticut Many services are subject to sales and use tax in connecticut. are services subject to sales tax in connecticut? Business services impacted by taxation: Like most states that levy sales and. certain services rendered at the residence of a disabled person: are services taxable in connecticut? repair services to electrical or electronic devices including but not. Are Maintenance Services Taxable In Connecticut.

From www.indiafilings.com

GST Accounts and Record Maintenance Procedure Are Maintenance Services Taxable In Connecticut here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. Landscaping and horticulture services, window cleaning. repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. Like most states that levy sales and. are services subject to sales. Are Maintenance Services Taxable In Connecticut.

From slideplayer.com

Tax Law and Benefits for Homeownership ppt download Are Maintenance Services Taxable In Connecticut Many services are subject to sales and use tax in connecticut. connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. are services subject to sales tax in connecticut? repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. are services taxable. Are Maintenance Services Taxable In Connecticut.

From www.factorywarrantylist.com

Connecticut Car Tax Calculator 50,000 at 6.35 or 7.75 Are Maintenance Services Taxable In Connecticut connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. Many services are subject to sales and use tax in connecticut. Landscaping and horticulture services, window cleaning. repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. are services subject to sales tax. Are Maintenance Services Taxable In Connecticut.

From portal.ct.gov

District 2 Maintenance Are Maintenance Services Taxable In Connecticut repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. are services subject to sales tax in connecticut? Landscaping and horticulture services, window cleaning. Like most states that levy sales and. The state of connecticut does not usually collect sales taxes from the. here’s what merchants need to know about. Are Maintenance Services Taxable In Connecticut.

From www.nobroker.in

Everything You Need To Know About VVMC Property Tax Are Maintenance Services Taxable In Connecticut repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. are services taxable in connecticut? here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. Business services impacted by taxation: Landscaping and horticulture services, window cleaning. connecticut. Are Maintenance Services Taxable In Connecticut.

From wershoft.blogspot.com

Software Maintenance Taxable In California WERSHOFT Are Maintenance Services Taxable In Connecticut connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. Landscaping and horticulture services, window cleaning. are services taxable in connecticut? here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. Many services are subject to sales and. Are Maintenance Services Taxable In Connecticut.

From hitechfm.com

1 Best Annual Maintenance Contract Packages HiTech Facility Are Maintenance Services Taxable In Connecticut here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. The state of connecticut does not usually collect sales taxes from the. Business services impacted by taxation: repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. are. Are Maintenance Services Taxable In Connecticut.

From theimsco.com

Ways Commercial Maintenance Services Can Add Value to Your Building IMSCO Are Maintenance Services Taxable In Connecticut repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. are services subject to sales tax in connecticut? The state of connecticut does not usually collect sales taxes from the. here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate. Are Maintenance Services Taxable In Connecticut.

From cthomegeneratorsystems.com

Preventative Maintenance Are Maintenance Services Taxable In Connecticut certain services rendered at the residence of a disabled person: connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. are services taxable in connecticut? repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. here’s what merchants need to know. Are Maintenance Services Taxable In Connecticut.

From www.a2ztaxcorp.com

Supply of repair services along with spare parts/ accessories is Are Maintenance Services Taxable In Connecticut connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. The state of connecticut does not usually collect sales taxes from the. here’s what merchants need to know about taxing services in the. Are Maintenance Services Taxable In Connecticut.

From pwsc.com

Homeowner Home Maintenance Guides Professional Warranty Service Are Maintenance Services Taxable In Connecticut Business services impacted by taxation: certain services rendered at the residence of a disabled person: are services taxable in connecticut? connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. The state. Are Maintenance Services Taxable In Connecticut.

From www.slideserve.com

PPT Turnkey Asset Maintenance Services (TAMS) Contracts Overview Are Maintenance Services Taxable In Connecticut Many services are subject to sales and use tax in connecticut. Like most states that levy sales and. connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. Business. Are Maintenance Services Taxable In Connecticut.

From slideplayer.com

Service Tax on International Transactions Nishant Shah Economic Laws Are Maintenance Services Taxable In Connecticut repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. Like most states that levy sales and. Many services are subject to sales and use tax in connecticut. Business services impacted by taxation: The state of connecticut does not usually collect sales taxes from the. connecticut imposes a 6.35% sales and. Are Maintenance Services Taxable In Connecticut.

From bhaskervasta.com

Accounting & Taxation Bookkeeping IT and GST Returns Filing Are Maintenance Services Taxable In Connecticut Like most states that levy sales and. are services taxable in connecticut? are services subject to sales tax in connecticut? Many services are subject to sales and use tax in connecticut. The state of connecticut does not usually collect sales taxes from the. here’s what merchants need to know about taxing services in the state of connecticut,. Are Maintenance Services Taxable In Connecticut.

From www.facebook.com

Facebook Are Maintenance Services Taxable In Connecticut The state of connecticut does not usually collect sales taxes from the. Many services are subject to sales and use tax in connecticut. certain services rendered at the residence of a disabled person: repair services to electrical or electronic devices including but not limited to air conditioning and refrigeration equipment;. Business services impacted by taxation: connecticut imposes. Are Maintenance Services Taxable In Connecticut.

From www.sanjuancollege.edu

Industrial Maintenance Mechanic Certificate San Juan College Are Maintenance Services Taxable In Connecticut certain services rendered at the residence of a disabled person: here’s what merchants need to know about taxing services in the state of connecticut, where the state sales tax rate is 6.35%. connecticut imposes a 6.35% sales and use tax, with certain exceptions, on a wide range of services. repair services to electrical or electronic devices. Are Maintenance Services Taxable In Connecticut.